THE MEDIUM-TERM MANAGEMENT PLAN

- Numerical targets

- Shareholder distributions policy

- Policies on the new Medium-Term Management Plan

- Business portfolio

Medium-Term Management Plan for FY3/22 to FY3/26

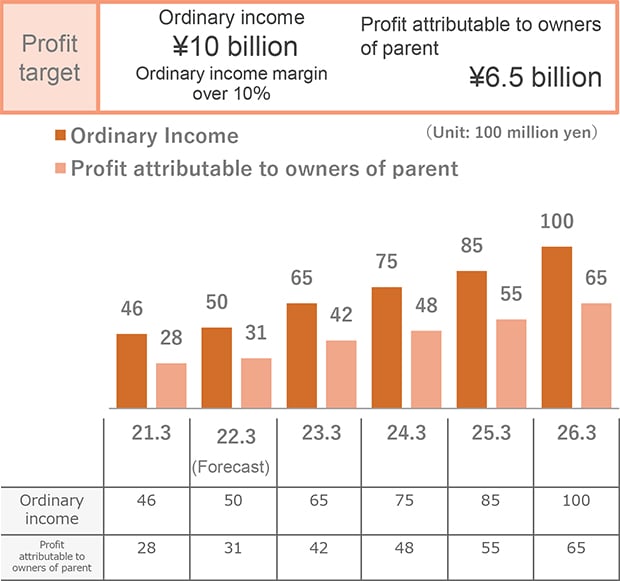

Numerical targets

- Improve profitability and slim down balance sheets to achieve stable earnings growth and improve financial soundness

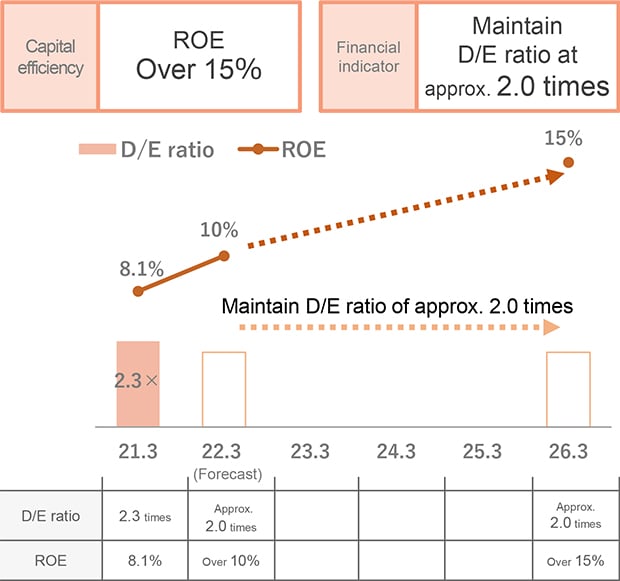

- Plan to improve ROE and EPS through completed capital restructuring

- Plan net sales of around \92 billion in FY3/26, without pursuing excessive scale expansion

-

Profit plan

-

Capital and financial policies

Improvement of profit margin

- [Improvement of business cycle/efficient use of B/S] → Improve gross profit margin in residential property sales business and reduce sales/inventory costs

- [Strengthening of business portfolio] → Expand highly profitable business (rental profit/overseas share of profit of entities accounted for using equity method)

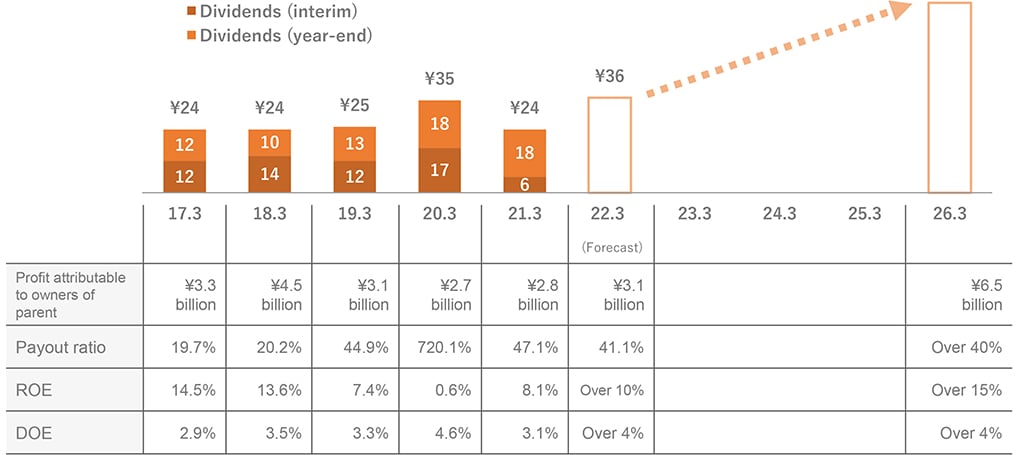

Shareholder distributions policy

Revised the distributions policy from “total distributions ratio of over 40% ” to “ payout ratio of over 40% and DOE of over 4%”

With the introduction of DOE, enhance the shareholder distributions by improving the downward rigidity of dividends while maintaining performance linked profit distributions

Policies on the new Medium-Term Management Plan

The new Medium-Term Management Plan for five years from FY3/22 to FY3/26 will drastically restructure both our bases and strategies in response to recent environmental/social needs by leveraging our strengths since our foundation.

Fundamental strategy focusing on “region, seniors, and the wealthy,” which showed successful results, will remain the same

-

Strategies

Establishment of stable supply/ stable earnings system

- Restructure all businesses under the theme of “Housing” with regions and proper condominiums for senior as the core

- Realize stable and sustainable growth through above measures

- Ensure to improve capital efficiency as a source of corporate value

Challenges for future business growth

- Real Estate Investment business: secure its position as the second pillar

- CCRC: start making profit and become the third pillar

- Overseas business: start making profit from FY3/22 to become the pillar in 10 years

-

Bases

Integration of business strategy and ESG strategy

- Contribute to solving social issues through our business

- Continue to enhance corporate governance

- Respond to global uncertainty/risk management

Ongoing enhancement of corporate value focusing on all stakeholders

- Continue to enhance financial base

- Continue to improve ROE

- Enhance shareholder distributions

Integration of business strategy and ESG strategy

Initiatives to solve social issues - We create the Life that you dream -

- Regional revitalization: Contribute to regional revitalization through Real Estate Development (regional redevelopment), PFI business, and related services

- Super-aged society: Provide new lifestyles meting a super-aged society mainly through CCRC

- Diversity: Provide diversified living styles mainly through Real Estate Investment (rental) and condominium apartments

- Create a resilient city -

- Response to diversified set of values in light of COVID-19

- Initiatives for regional revitalization

- Response to super-aged society

- Become a sustainable company -

- Response to uncertainty/changes in real estate market

- Enhancement of corporate governance and diversity

- Environmental friendliness and work-style reforms

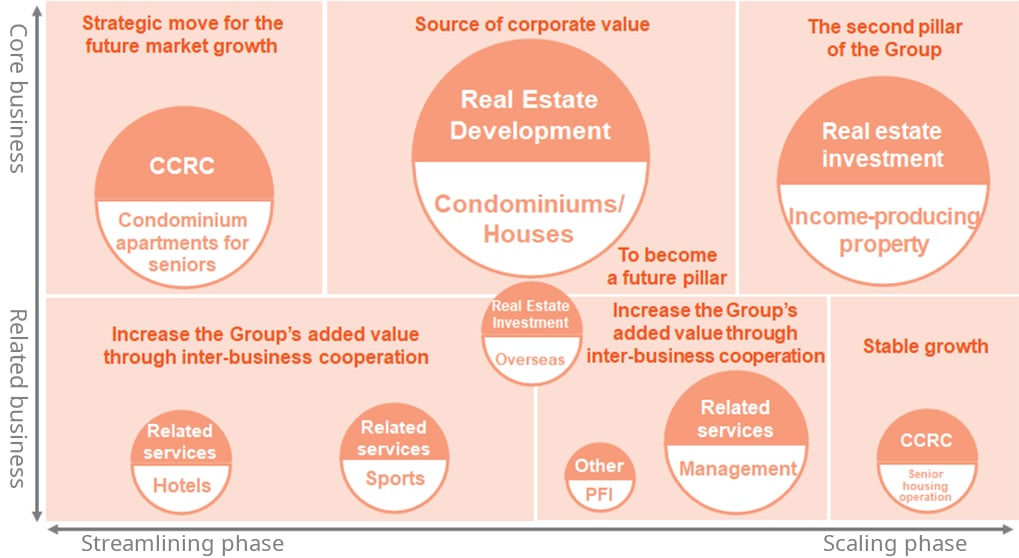

Business portfolio

- Real Estate Development is our predominant core business and absolute earnings base

- CCRC and Real Estate Investment are growing into new pillars

- Management/senior housing operation are expected to show a steady growth with an increase in condominium supply

- Further enhance CCRC and Real Estate Investment and seek the growth with overseas business as a candidate for next pillar

※An image of average profit composition during the period covered by the Medium-Term Management Plan, not of a particular single year.

The size of a circle represents the size of profit of each business.

Strategic policy for each portfolio

| Business | Strategic policy |

|---|---|

| Real Estate Development CCRC |

|

| Real Estate Investment |

|

| Property Management and Related Services |

|

Real Estate Development + CCRC

- Focus management resources on “residential property development” business having a potential for earnings growth and secure a certain level of supply and net sales

- Contribution to profit attributable to owners of parent is estimated to be more than ¥3 billion on a steady basis after FY3/23, generating source for dividends with DOE at 4%

-

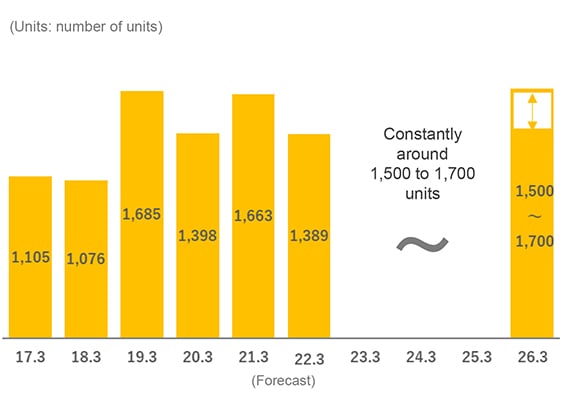

Units (to be) delivered

-

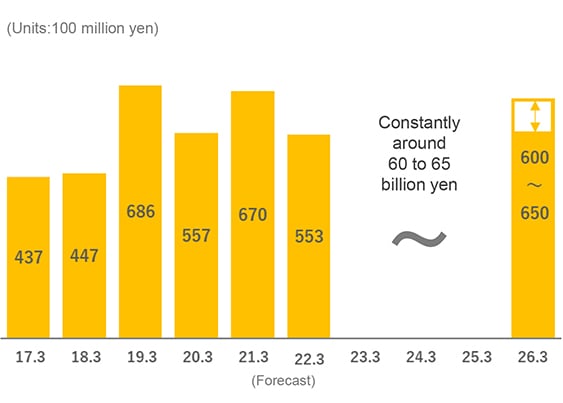

Net sales

※The number of units (to be) delivered above is the sum of condominium apartments, houses, and condominium apartments for seniors.

Figures are before elimination of intersegment transactions and are rounded down to the nearest million yen.